tax incentives for electric cars ireland

Now the charging continues safely without any interruption as the unit automatically adjusts the appropriate level of power when multiple devices are on in the house. Reliefs have been removed for any electric vehicles above 50000.

Uk Lowers Ev Subsidies Again Electrive Com

The grant administered by the Sustainable Energy Authority Of Ireland SEAI was on top of the 5000 tax rebate on Vehicle.

. VRT is paid whenever a car is registered for the first time in Ireland. Drivers who make the switch to EVs also benefit from Government purchase incentives up to a value of 10000 5000 VRT relief and 5000 SEAI grant a 600 SEAI home charger grant scheme qualify for the lowest band of road tax 120 per annum and access to an extensive network of public chargers which are presently free to use. All Tesla cars have zero emissions and may be eligible for financial incentives that encourage clean energy use in Ireland.

5000 SEAI plug-in grant for personal purchase of Model 3 Standard Range Plus. Lowest VRT tax band 7 Low annual road tax of 120. TAX BENEFITS PURCHASE INCENTIVES wwwaceaauto 3.

President Bidens EV tax credit builds on top of the existing federal EV incentive. EV buyers can currently get a purchase grant of up to 5000 home charging point installation support of 600 relief on vehicle registration tax. However from 1 July the maximum grant available.

Vehicles with an Open Market Selling Price OMSP of up to 40000 will be granted relief of up to 5000. SEAI offer a range of charging grants for private and commercial electric vehicles. This 30 may be reduced if you incur high.

VAT at 23 is additionally part of the price of all new cars in Ireland. Government changes tax incentives for electric cars and hybrids. Electric Car Servicing Costs A big difference between traditional and electric cars is that electric cars dont need nearly as much servicing as traditional cars.

This relief is in place until the end of 2021. You can calculate your motor tax here. There are also a number of grants available to business owners for purchasing electric company cars and the installation of chargers at the home offers a Government grant of up to 600.

Now is the perfect time to purchase with several attractive government incentives in place for those considering an electric vehicle in Ireland. The Motor Tax on a Battery Electric Vehicle in Ireland is the lowest rate possible which is 120 a year. 74500 96500 Tax Payable 125.

Will run until December 31st 2022 or up to a maximum of c. 2 - Motor Tax Motor tax for electric vehicles is cheaper than for diesel vehicles coming in at 140 for battery-operated vehicles BEVs - from 1 January 2021 and under 170 for most plug-in hybrid electric vehicles PHEVs. SEAI Grant of up to 5000 worth 5000 for Electric vehicles 2500 for plug-in hybrids.

3 - Cheaper Tolls BEV and PHEV owners can enjoy discounts on their toll fees. I think this charging unit deserves every penny I spent for it like the car itself. As part of Budget 2022 the Dept of Finance have announced the phasing out of the 0 Benefit-in-kind on Electric Vehicles over the next 4 years.

A 600 grant is available towards the EV charger. A VRT rebate of up to 5000. Series production electric motorcycles are exempt from VRT until 31.

Our electric vehicle grants make it more affordable to switch to an EV. 88 100 18 125 Deductible Vehicle Costs. Electric Vehicle Fossil Fuel Vehicle.

Low Emissions Vehicle Toll Incentive LEVTI. Grants available for electric company cars with a Government incentive of up to 5000 grant per vehicle. 7350 for gross price of up to 32000 1500 if price between 32000-44000 ELECTRIC VEHICLES.

Vehicles with an OMSP of greater than 40000 but less than 50000 will receive a reduced level of relief. For this reason electric cars pay a road tax of 120 per year while a vehicle in the. We have a range of grants available for both new private and new commercial electric vehicles.

0 benefit-in-kind tax rate applies to the value of the car below 50000. In addition to the grants for the purchase of electric cars and the installation of the home charger unit there are other additional economic incentives to the benefit of electric mobility. Currently BIK on fully electric vehicles is 0 on an OMV Original Market Value up to 50000 after 50000 the 30 rate of Benefit in Kind applies.

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. VRT relief is up to 5000 for Battery Electric Vehicles BEV. Exemption for BEV and PHEV cars Exemption for BEV and PHEV cars.

Benefits for all Tesla drivers. It is typically reflected in the vehicle price displayed by a dealer. 9312 12063 Tax Saved.

From 15 June 2020 purchase incentives for electric cars. A 100 per cent FYA is available for expenditure on new plant and machinery installed for the purposes of charging an electric vehicle. BEV owners pay 50 of the toll rate PHEV 25 of the toll rate.

1500 NA Taxable Profits. Plugin hybrids can get a rebate of up to 2500 while VRT of up to 5000 can be paid back on fully electric cars so youre typically looking at a. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

At the moment full electric cars and plug-in hybrids can qualify for grants of up to 5000 from the Sustainable Energy Association of Ireland. 1800 99 88 77. 100000 100000 Proportion of Deductible Vehicle Costs.

For example in Ireland registration and motor tax rates are calculated based on CO2 emissions. 24000 3500 Deductible Charge Point. Electric Vehicle Toll Incentive EVTI Capped at 500 for private or 1000 a year for commercial LGV SPSV and HDV.

Zero- and low-emission company vehicles not more than 50gkm. Electric Vehicles receive VRT relief separately to SEAI grant support. Choose your make and model today and buy from our dealers list.

These Countries Have The Most Electric Cars Check List Mint

Could Electric Cars Be The Norm In Just A Few Decades Shell Global

10 Cheapest Electric Cars To Buy In 2021 Edf

Best Electric Cars And Evs For 2022 Cnet

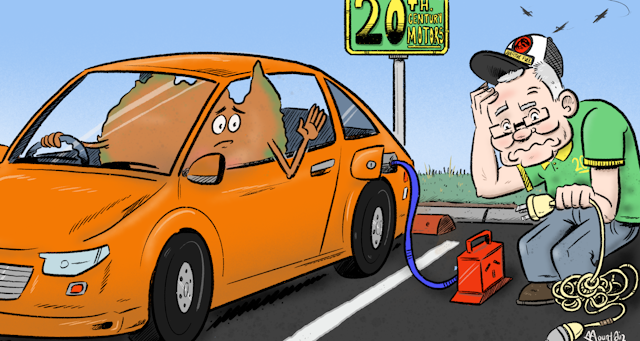

Why Risk An Electric Car If You Can T Charge It Business The Sunday Times

Greece Introduces Purchase Subsidy For Electric Vehicles Electrive Com

Tesla Model 3 Reservation Holder Survey Tells An Exciting Tale Tesla Model Tesla Car Tesla

Tracking Electric Vehicles 2020 Analysis Iea

Electric Cars Are Coming And If You Don T Like It Tough

Norway Considers Introducing Luxury Ev Tax Electrive Com

Best Electric Cars For Uber Drivers Inshur

Why You Shouldn T Buy An Electric Vehicle For Your Family Road Trip Newfolks

Ev Subsidies On Hold In Sweden The Netherlands Electrive Com

What S Put The Spark In Norway S Electric Car Revolution Motoring The Guardian

Top Economists Call For Measures To Speed The Switch To Electric Cars

China S Carmakers Are Making Cheaper Electric Vehicles And They Have Their Sights On Europe Euronews

How Electric Vehicles Could Lead Post Pandemic Charge Ey Building A Better Working World